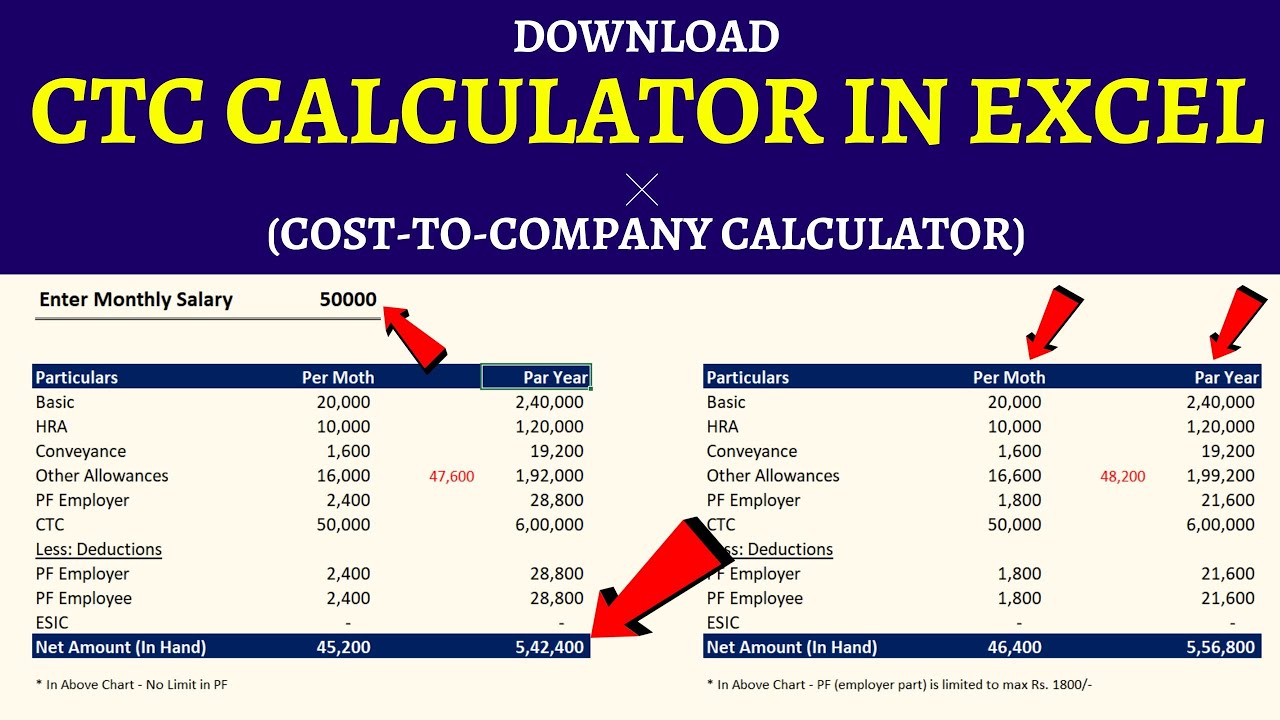

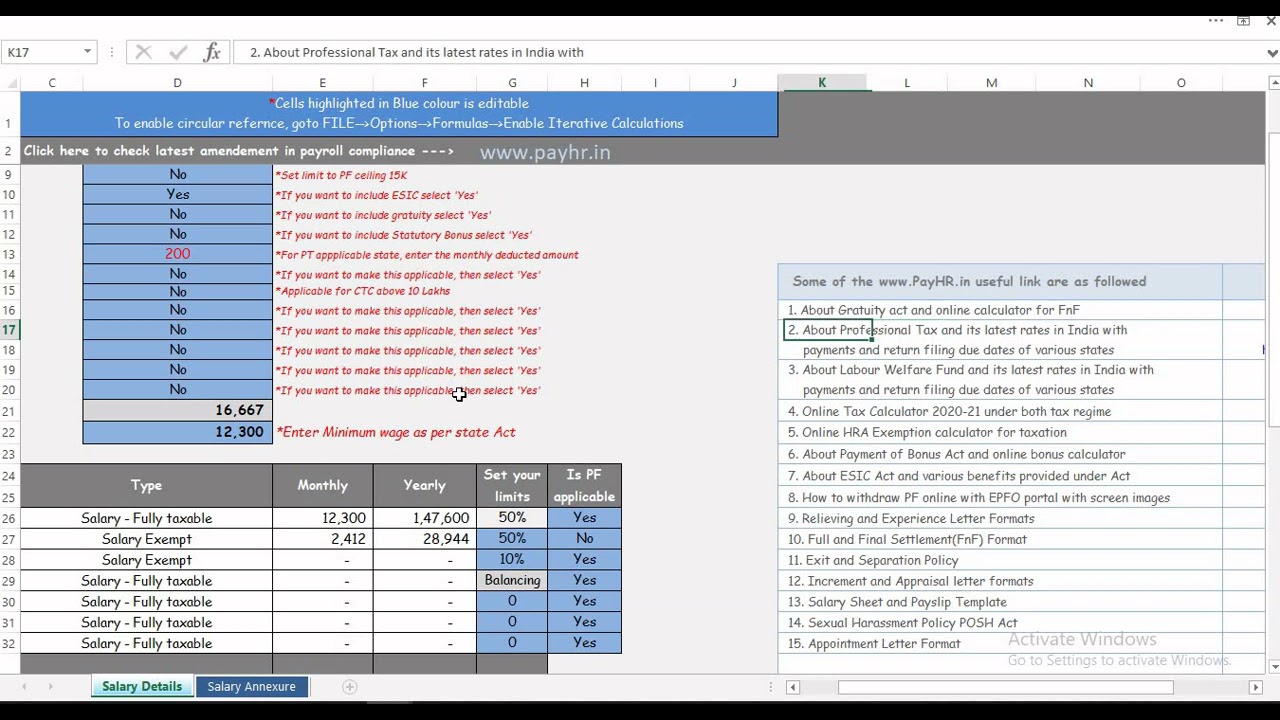

How To Calculate Additional Ctc 2025. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all. Enter the annual income (ctc amount):

On january 31, 2025, the us house of representatives passed. An expanded child tax credit passed the house of representatives on wednesday night.

Download CTC Calculator in Excel 📊 Calculator) YouTube, It is claimed by families who owe the irs less than their qualified child tax credit amount. Before we get into calculating the child tax credit, let's spend a bit of time understanding it.

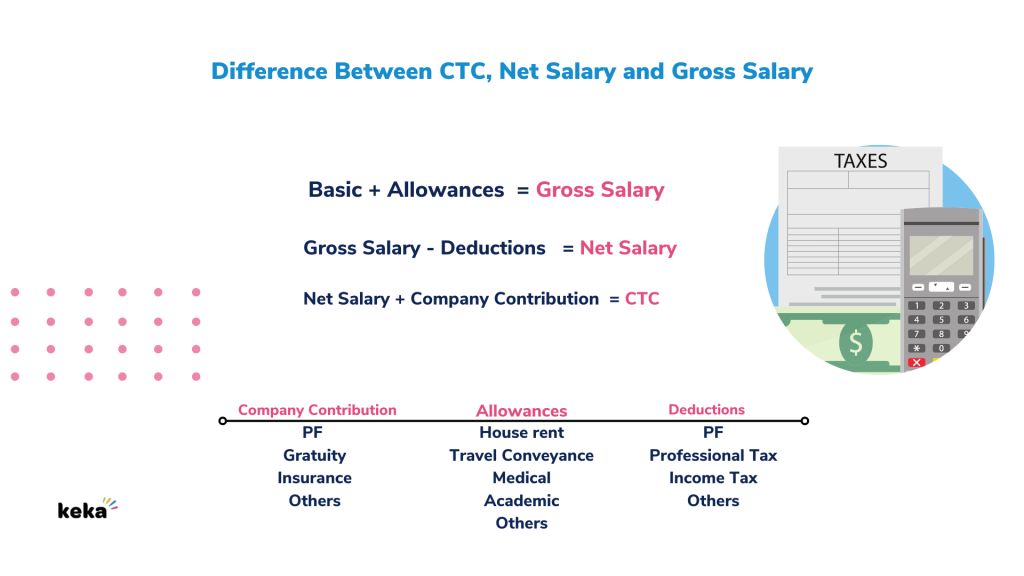

What is Cost to Company { CTC } ? Meaning & Definition Keka HR, For the 2025 tax year (returns you'll file in 2025), the refundable portion of the credit increases to $1,700. Iptm automatic ctc calculator online to calculate free salary breakup along with various payroll compliances and rules sets by employer in india.

SALARY 2025 How to Calculate CTC, Salary & Tax 2025 New, For the 2025 tax year (returns you'll file in 2025), the refundable portion of the credit increases to $1,700. Your salary slip has two main sections.

Child Tax Credit CTC Update 2025, The new calculation would multiply the parent's income by 15% as well as by the family's number of children. The ctc’s refundable portion phases in at 15 percent for each dollar in earnings above $2,500.

[SOLVED] HOW TO CALCULATE CTC FROM MONTHLY SALARY? YouTube, An expanded child tax credit passed the house of representatives on wednesday night. It is claimed by families who owe the irs less than their qualified child tax credit amount.

![[SOLVED] HOW TO CALCULATE CTC FROM MONTHLY SALARY? YouTube](https://i.ytimg.com/vi/Aicc4q8dKj4/maxresdefault.jpg)

How to use PayHR Excel CTC Calculator YouTube, That's an important change because it means families. What is the child tax credit?

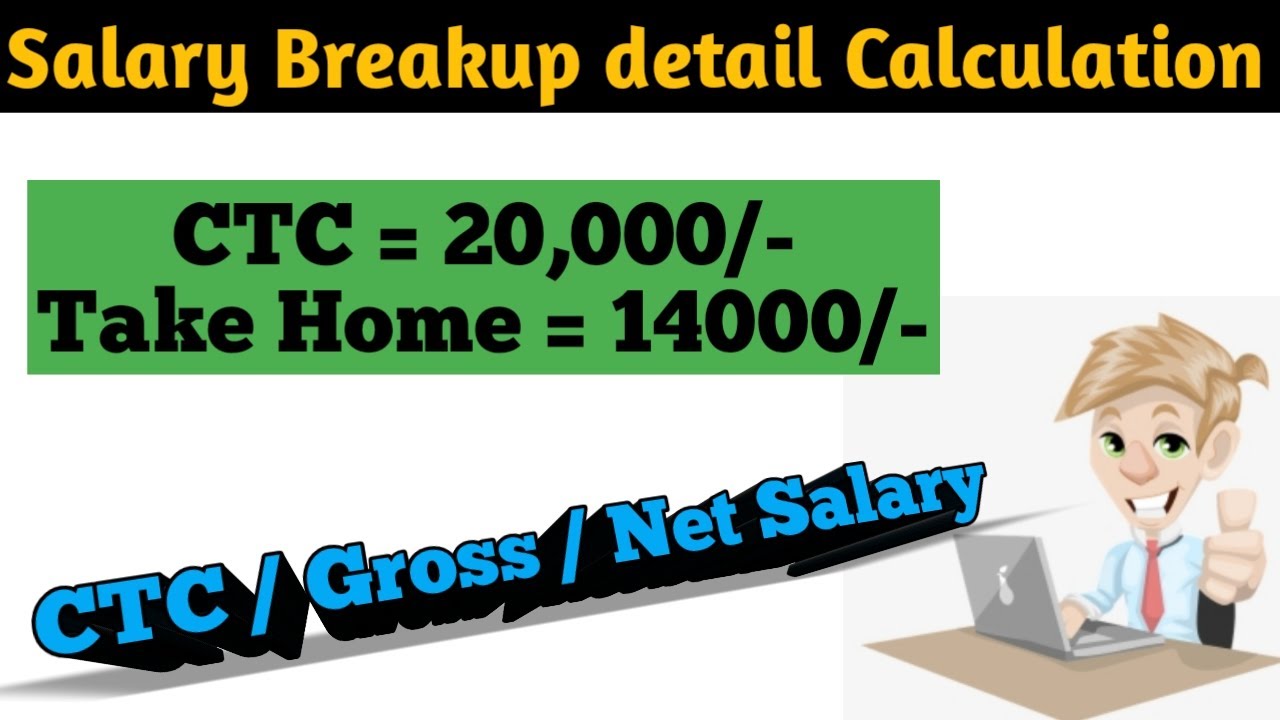

How to calculate CTC Difference between CTC vs Gross vs Net Salary, The child tax credit (ctc) can reduce the amount of tax you owe by up to $2,000 per qualifying child. File up to 2x faster than traditional options.* get your refund, and get on with your life.

CTC Full Form, Cost to Company, Salary In Hand From Gross Pay., Currently, the maximum refundable child tax credit is. What is the additional child tax credit?

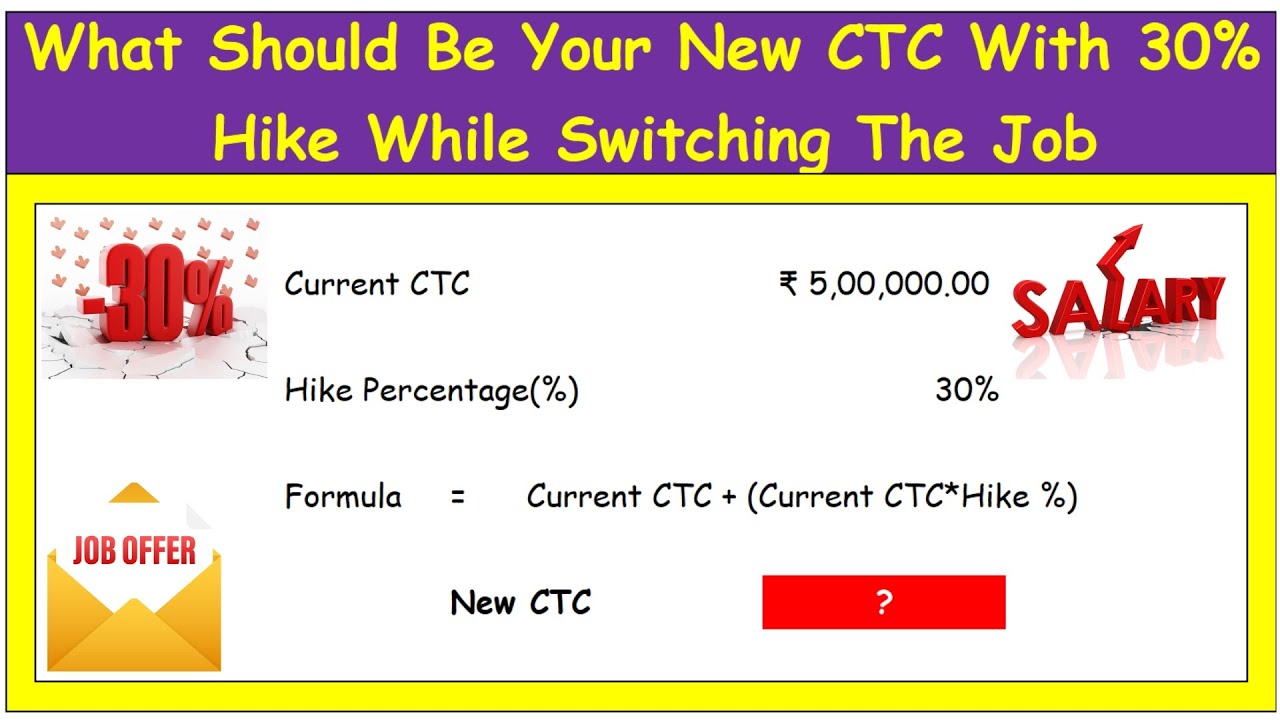

What Should Be Your New CTC With 30 Hike While Switching The Job New, If the bill is enacted, it would significantly increase the child tax credit. The new calculation would multiply the parent's income by 15% as well as by the family's number of children.

CTC vs Gross vs InHand Salary How to Calculate InHand Salary from, While the child tax credit. For the 2025 tax year (returns you'll file in 2025), the refundable portion of the credit increases to $1,700.

The child tax credit (ctc) can reduce the amount of tax you owe by up to $2,000 per qualifying child.