Mileage Reimbursement 2025 Illinois. While there is no federal law that requires employers to provide mileage reimbursement, 3 states have enacted laws. Illinois has a similar mileage reimbursement law to california, stating that “employees shall be reimbursed for.

States that mandate mileage reimbursement. Effective january 1, 2025, state travel reimbursement rates for lodging and mileage for automobile travel, as well as allowances for meals, shall be set at the maximum rates established by the federal government for travel expenses, subsistence expenses, and.

On january 1, 2025, the gsa announced that the mileage reimbursement rate will increase from 65.5 cents per mile to 67 cents per mile effective january 1, 2025.

Illinois Mileage Rate 2025 Bili Mariya, Mileage reimbursement is when a company reimburses an employee who used their personal vehicle (car, van, truck, etc.) for business use. Effective january 1, 2025 the new reimbursement rate is 67 cents per mile.

Mileage Reimbursment 2025 Minna Sydelle, What is the illinois mileage reimbursement. The irs annually publishes a standard mileage reimbursement rate organizations can adopt or use as a barometer to.

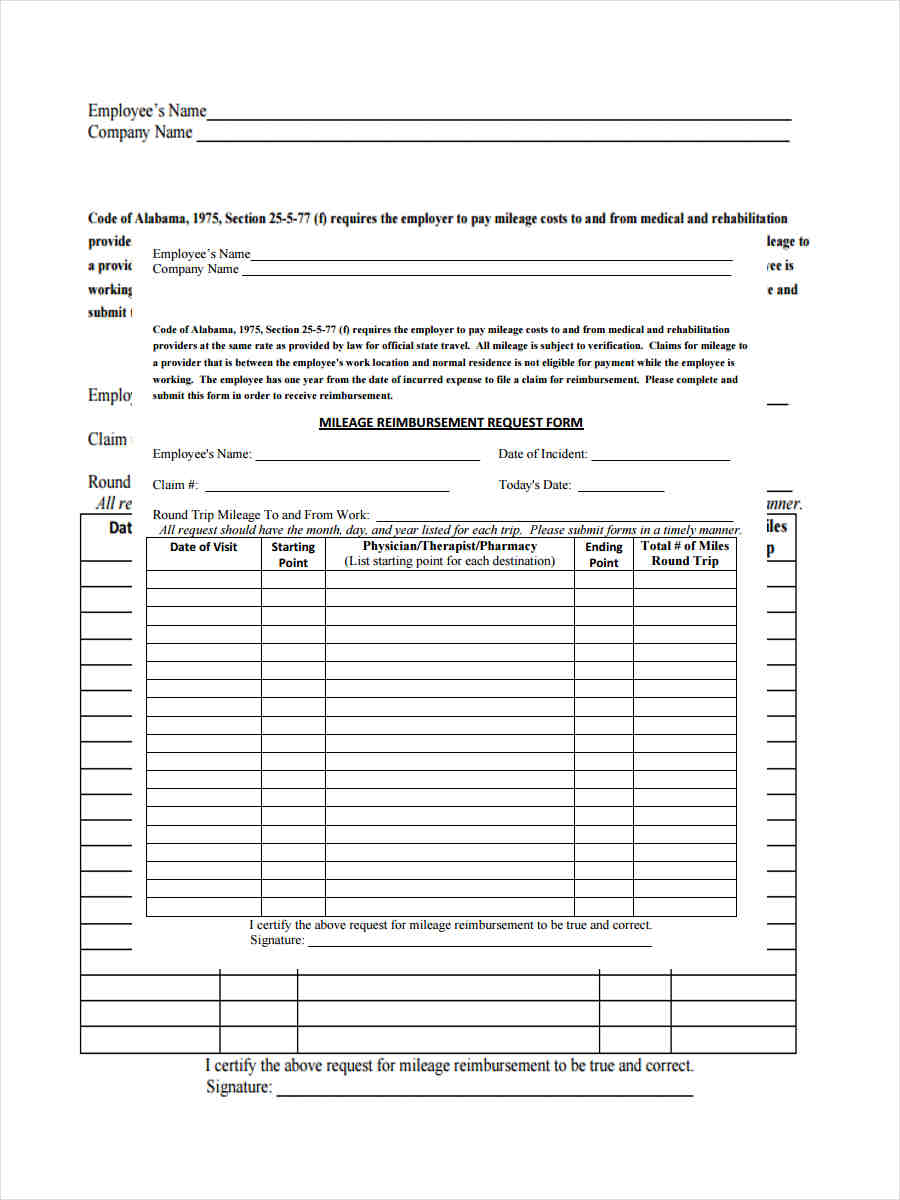

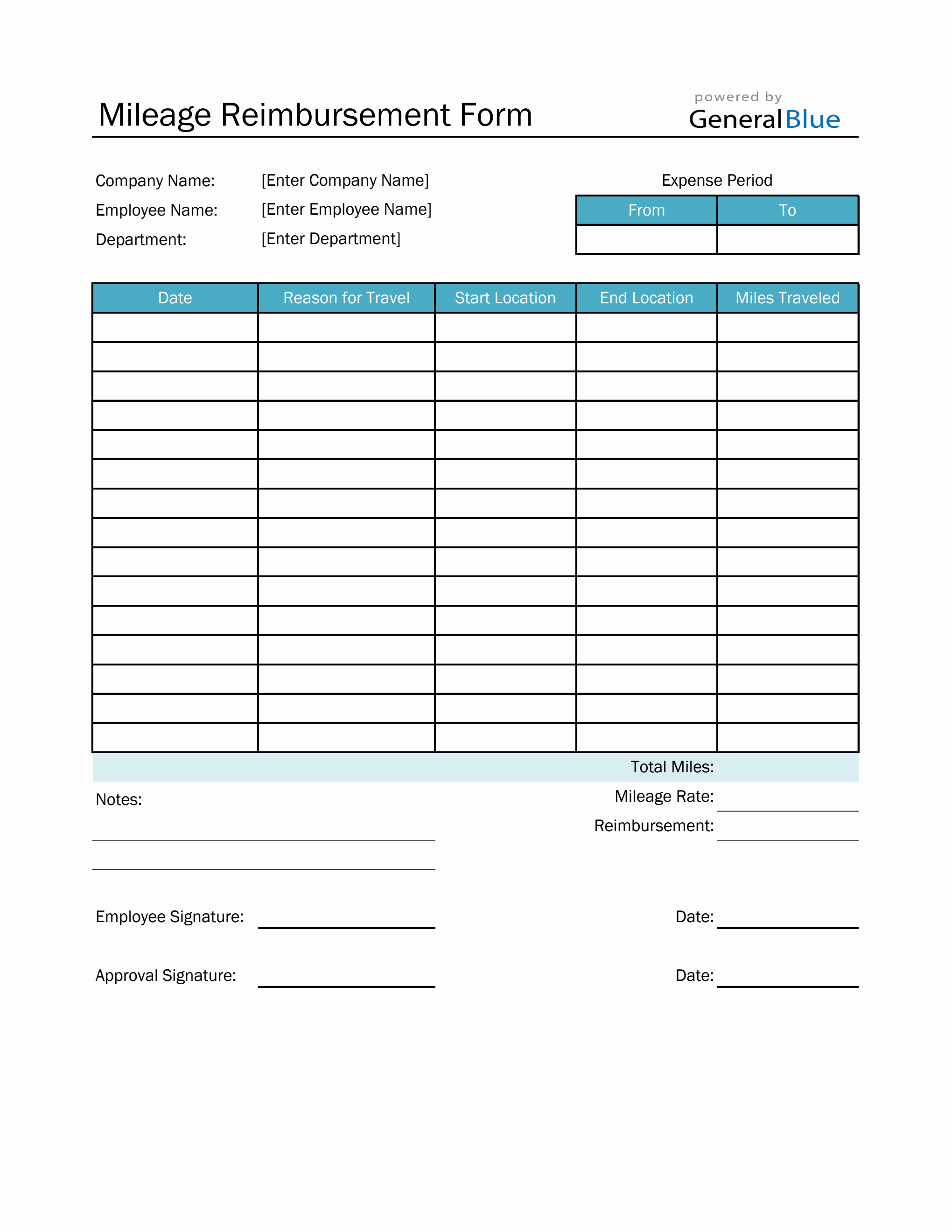

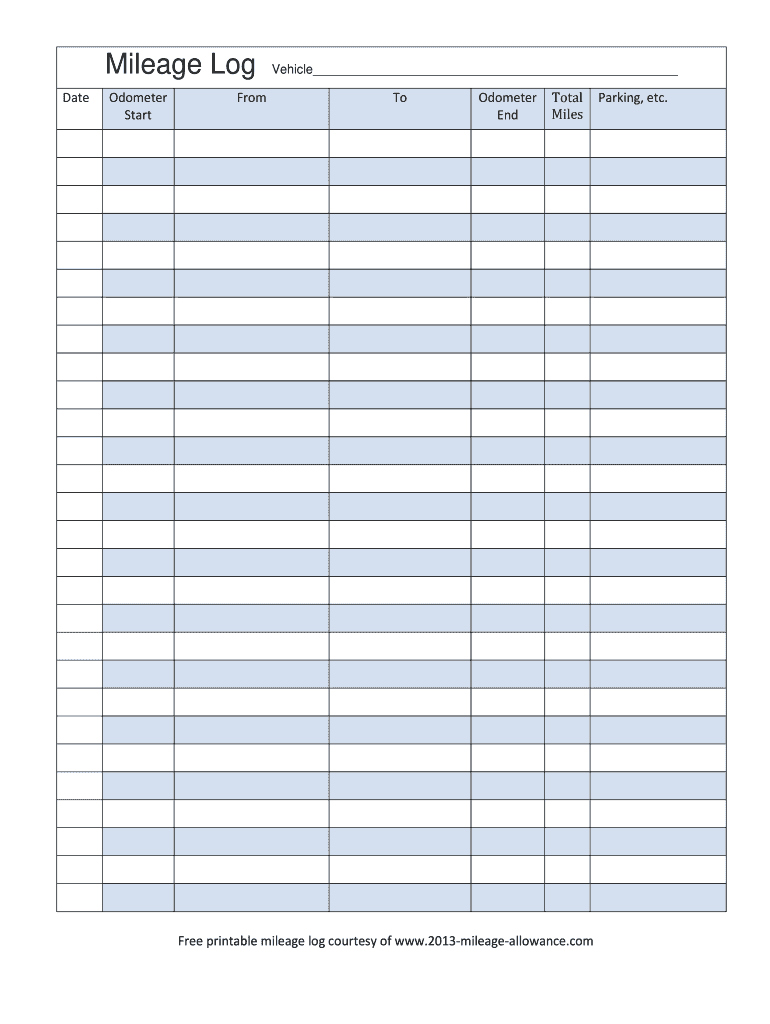

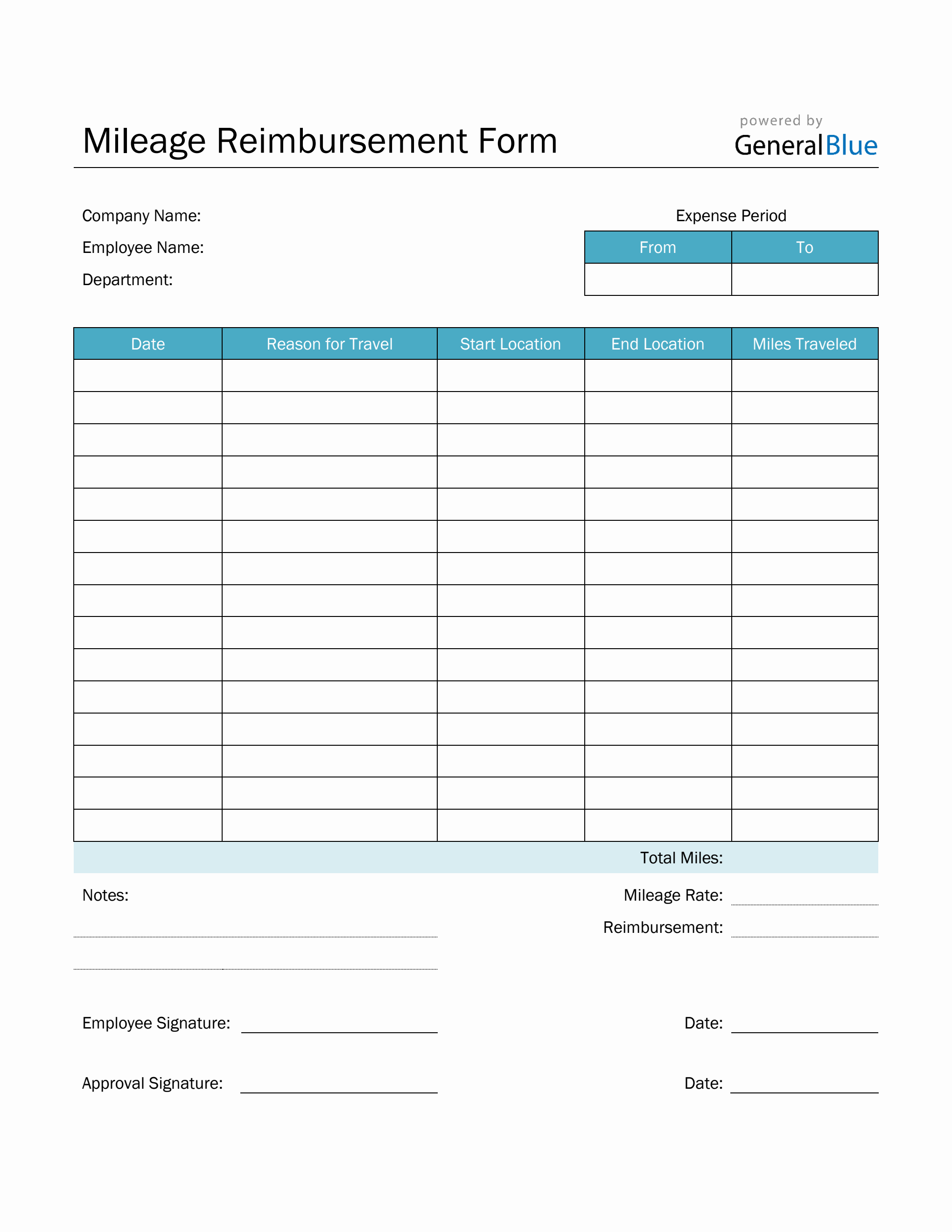

Mileage Reimbursement Form 2025 Printable Free Fran Timothea, 65.5 cents per mile), company pay for the tolls, but gas, maintenance, and insurance is on my own. Establishes the fiscal year 2025 and 2025 mileage reimbursement rate and allowance for lodging and meals.

Irs Standard Mileage Reimbursement Rate 2025 Elsi Nonnah, While there is no federal law that requires employers to provide mileage reimbursement, 3 states have enacted laws. Establishes the fiscal year 2025 and 2025 mileage reimbursement rate and allowance for lodging and meals.

2025 Mileage Reimbursement Rate Calculator Nan Lauren, Illinois has a similar mileage reimbursement law to california, stating that “employees shall be reimbursed for. On january 1, 2025, the gsa announced that the mileage reimbursement rate will increase from 65.5 cents per mile to 67 cents per mile effective january 1, 2025.

How Much Is Mileage Reimbursement For 2025 Deny, Mileage reimbursement is when a company reimburses an employee who used their personal vehicle (car, van, truck, etc.) for business use. Effective january 1, 2025, the mileage reimbursement rate for employees using private passenger vehicles for university business will increase from 65.5 cents.

What Is The 2025 Mileage Reimbursement Rate Janey Lisbeth, Mileage rate increases to 67 cents a mile, up 1.5 cents from 2025. What is the illinois mileage reimbursement.

Irs Medical Mileage Rate 2025 Reimbursement Luisa Timothea, Effective january 1, 2025, the mileage reimbursement rate for employees using private passenger vehicles for university business will increase from 65.5 cents. Amends the compensation review act.

Mileage Reimbursement Form Template Fillable Free, While there is no federal law that requires employers to provide mileage reimbursement, 3 states have enacted laws. Illinois has a similar mileage reimbursement law to california, stating that “employees shall be reimbursed for.

Il Mileage Reimbursement 2025 Ambur Bettine, Code sections 3000.300 (f) (2) and 2800 appendix a, reimbursement for use of a private vehicle while traveling on official government business shall be on a mileage. Irs issues standard mileage rates for 2025;

Mileage reimbursement is when a company reimburses an employee who used their personal vehicle (car, van, truck, etc.) for business use.

Illinois mileage reimbursement requirements explained (2025) download our free illinois mileage compliance guidebook.